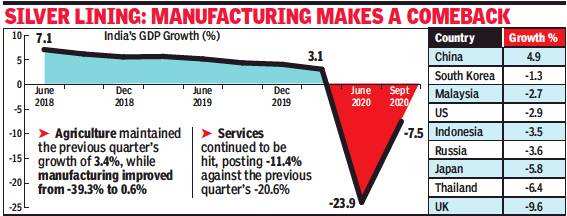

NEW DELHI: India’s economy contracted for the second successive quarter but the pace of decline narrowed sharply in the three month period ending September as the farm sector held strong while manufacturing returned to the positive zone. However, the crucial services segments fell for the second quarter in a row.

Data released by the National Statistical Office (NSO) on Friday confirmed that the economy plunged into recession with two successive quarters of contraction. This is the first time that the economy posted two successive contractions since the government started publishing quarterly GDP data in 1996.

Experts said the worst may be over for the economy, although risks persisted, and cautioned about the impact of the fresh wave of Covid-19 infections and localised lockdowns on demand and growth in the months ahead. For the 2020-21 fiscal year, the economy is estimated to still post a contraction, possibly in double digits, and rebound next year as economic activity gathers momentum and the impact of the string of government measures to help revive growth kicks in.

The NSO data showed the economy contracted by 7.5% in the July-September quarter, the second quarter of the country’s 2020-21 fiscal year, narrower than the record 23.9% decline posted in the April-June quarter. India’s economy still remains in the league of large economies which have contracted the most in the second quarter, with only the UK, which declined 9.6% in the September quarter, faring worse. China is the only large economy that posted growth in the September quarter (4.9%).

The government’s chief economic adviser KV Subramanian said the data for the second quarter was better than expected and there was a potential for an upside, but urged caution given that fresh wave of infections.

The numbers showed that the narrowing of contraction was led by the manufacturing sector, electricity, construction and agriculture. The construction sector, which had slumped to a decline of 50.3% in the June quarter, displayed some recovery declining by 8.3%. Since the government announced the lifting of the strictest lockdown imposed to prevent the spread of the pandemic in June, several indicators have pointed to a recovery and significant narrowing.

“Expectedly, the worst for the economy is over. That said, the economy is still not out of the woods and the improvement in activity from here onward would likely be laboured,” said Kunal Kundu, India economist at French investment Bank Societe Generale.

“But with signs of emerging fatigue in recent demand uptick and the second wave of infections already impacting economic activity, we would retain our view of FY21 real GDP contracting by 8.6%, given the likelihood of a much weaker third quarter activity,” said Kundu.

The manufacturing sector posted a paltry growth of 0.6% in the September quarter compared to the 0.6% contraction in the second quarter of FY20 and experts attributed it to lifting of lockdown restrictions. The trade, hotel and transport segments registered the highest contraction amongst the sectors during July-September period declining by an annual 15.6%. The services sector, which accounts for nearly 60% of gross domestic product, contracted for the second successive month by 11.4%, narrower than the 20.6% in the previous quarter. The sector has borne the brunt of the pandemic as hotels, restaurants, cinemas had been shuttered for the longest time and people stayed away due to the fear of infections.

Private consumption, a key driver of the economy, contracted 11.3% from an expansion of 6.4% in the year-ago period while government consumption showed sharp decline in growth 22.2% in the September quarter compared to 16.4% growth in the June quarter. Investment growth continued to contract with gross capital formation or investments was 7.5% lower in Q2 FY21 from an year ago, according to an analysis by Care Ratings. Some experts expressed doubt about some of the sectoral numbers.

“It is understandable to feel better at lower contraction at 7.5% in Q2. Numbers, however, don’t add up. Low gross fixed capital formation contraction at only 7.3% despite down new projects, ongoing projects on hold, govt capex down is inexplicable. So is manufacturing growth despite demand slowdown,” former finance secretary Subhash Chandra Garg said on micro-blogging site Twitter.

Some economists said they expect growth to improve in the remaining two quarters of 2020-21 as economic activity improves across sectors.

“The economy however continues to face downward pressure, from the sustained spread of the pandemic in the country and the re-imposition of restrictions in various regions. Consumption demand and investments which are necessary to propel the economy would continue to be tepid and is unlikely to see a noteworthy improvement during the course of the year. We expect the country’s GDP to contract by -7.7% to -7.9% in FY21,” said Madan Sabnavis, chief economist at Care Ratings.

0 Comments